Storage costs or warehousing costs

Trading companies and manufacturing firms usually have a warehouse or distribution center. Raw materials, consumables and supplies, intermediate products, semi-finished products, finished products and spare parts are stored in them. The storage of these goods incurs costs, which in total are referred to as warehousing costs, storage costs or inventory costs, and which in turn account for a large proportion of logistics costs.

A distinction is made between two types of storage costs: on the one hand, the costs directly related to the warehouse and, on the other hand, the interest costs for the capital tied up in the inventory. Since interest gains are lost there and thus do not contribute to the increase of capital, these costs are referred to as opportunity costs. In accounting terms, warehousing costs usually come under distribution costs, except when the storage contributes to the manufacturing process, such as in the fermentation of alcoholic beverages – in this case, warehousing costs are included in the manufacturing costs. How high the storage costs are depends on many factors, but it can be said that they are higher the lower the degree of automation and rationalization in the warehouse.

Components of warehousing costs

Many individual items together make up the warehousing costs. Depending on the perspective, these can be allocated and assigned differently.

- The costs of storage capacity

This includes the warehouse building itself, the storage facilities, such as shelving systems, the storage transport equipment, such as shelf conveyor systems and forklift trucks, and the costs for warehouse personnel.

- The costs of storage itself

The stored goods must be preserved in terms of quantity and quality, as is the case with food, for example, where preservation costs are incurred. In addition, interest costs are incurred for the capital tied up in the inventory, known as imputed interest.

- The costs of storage readiness

These include maintenance costs as well as expenses for lighting, cooling and heating.

- The costs of warehouse preparation and follow-up

Storage, relocation and retrieval incur costs, for example in the form of fuel and electricity for materials handling equipment (forklifts, driverless transport vehicles) and the conveyor landscape. Likewise, the costs for picking, unpacking and packaging (see also finishing / packing, value-adding processes) are among the storage and storage follow-up work.

There are also other types of distribution that create a different relationship between the individual items; thus, the following overarching points can also be formed in a profitability analysis with regard to costs:

- warehouse space (rent, maintenance, heating, lighting, water, cleaning, depreciation/impairment, return on invested capital, insurance)

- goods (interest on capital tied up in inventory, shrinkage/wear and tear/spoilage, breakage/damage/theft of goods, storage risk, insurance)

- Materials handling equipment (depreciation, operating costs, repair/maintenance, insurance, forklift trucks, Euro pallets)

- Material costs (packaging material and office material for warehouse management – see Green Logistics)

Alternatively also:

- Storage space (depreciation, interest, buildings, inventory, insurance, rent)

- inventory (interest, insurance, inventory losses)

- handling of inventory (transport of goods, operating costs of conveyor systems, weighing, measuring, mixing, dividing, ventilating, humidifying)

- warehouse management (personnel costs as well as hardware and software used)

Furthermore, a distinction can be made between fixed and variable costs, as well as between storage costs for finished products and for intermediate products. If there are several storage levels, such as incoming goods, production and finished parts, then the storage costs for each individual level must be calculated. Ultimately, the warehousing costs can only be accurately recorded and calculated if the points at which the storage services are provided are separated and recorded as cost centers or cost centers.

Relevance of warehousing costs

In numerous logistical decision-making problems, such as lot size planning (see lot size) or the implementation of logistics concepts such as just-in-time production, warehousing costs are of great importance with regard to economic success or failure; their reduction involves a considerable rationalization potential.

The best thing is to have the optimum stock level, which lies between too small and too large a stock level. If the stock is too small, machines and personnel are not utilized to capacity, while if the stock is too large, unnecessary costs are incurred; both lead to shortage costs. In industry, warehousing costs average around 50 percent of logistics costs, but in wholesale and retail, this share is considerably larger – ranging from 60 percent to 80 percent of total costs (balance sheet total).

The storage of goods therefore incurs financial costs that must always be carefully weighed against the costs and risk of delayed delivery in order to operate profitably. In particular, for inventory-intensive companies, warehousing costs play a major role; such companies include all those with a very high proportion of warehousing costs in their total costs or with a significant proportion of inventory in their total assets – the assets represent a portion of the company balance sheet that is used as capital within the company. Accordingly, the company has less money to fall back on. These types of companies are usually found in wholesale, retail and mechanical engineering.

Stock intensity / Inventory intensity

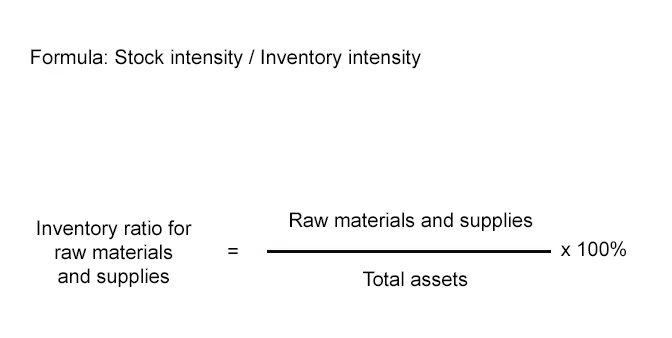

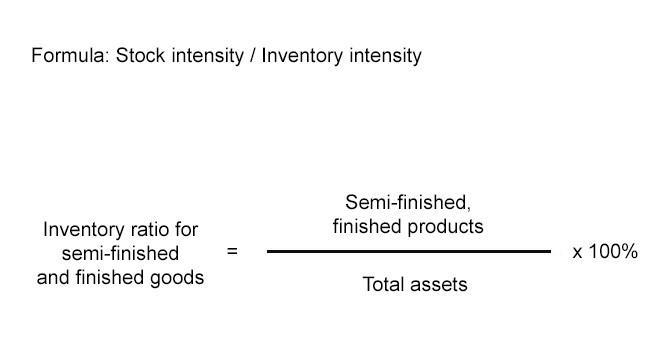

In this context, inventory intensity is an important key figure. It is also called stock intensity and expresses how much capital is tied up in the form of inventory. A high level of capital tie-up results in high costs and adversely affects both liquidity and profitability, as reflected in the inventory intensity formula below, for which the following figures from the annual balance sheet are required: inventory value (total value of inventory) and total assets (balance sheet total).

This formula can also be applied explicitly to raw materials and supplies on the one hand, and semi-finished and finished products on the other. In order for the inventory costs to be recovered as quickly as possible, the higher the inventory intensity, the greater the inventory turnover rate must be. If the inventory intensity increases, the causes must be determined; these may lie in increased production times or may be due to poor warehouse management or an inadequately maintained merchandise management system.

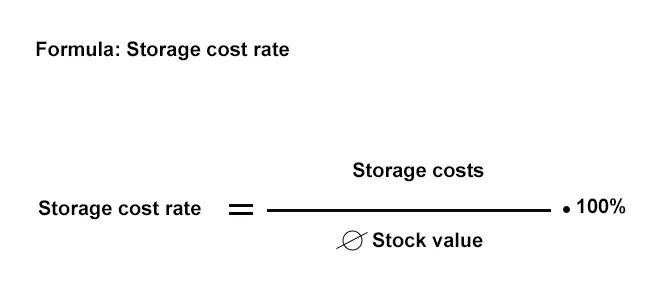

Inventory cost rate

Another important key figure is the inventory cost rate (ICR). Here, the warehousing costs are set in relation to the average inventory, for which the following formula is used:

The inventory cost rate can also be used to calculate the costs per individual item stored. For example, if the purchase price (also known as the purchase price – in accounting, this is the price at which merchandise is purchased) of a 10-liter bucket of paint is 50 euros and the LKS is ten percent, then the storage costs per bucket are five euros (ten percent of 50 euros) for the corresponding period of the initial data used. So the warehousing costs are calculated as a lump sum for the goods in stock, in proportion to the value of the goods. These storage costs must be included in the price calculation, because if the selling price is too high compared to the competition, the storage costs should be reduced, since they make up a significant portion of the total costs.

Reducing storage costs

Storage costs can be reduced in a number of ways; the main factor here is the inventory. Specifically, the following optimization potentials can be assumed:

- Determining the inventory and the relevant key figures as accurately as possible

The accuracy and completeness of the inventory results from the corresponding data/information. This can come from the last inventory and be compiled manually, or an ERP or merchandise management system can be used that continuously evaluates the stock levels and generates the required key figures. The inventory intensity and the inventory cost rate are then determined, which, when compared over time and across industries, provide information on the need for action.

- Inventory clearance

So-called slow-moving items must be identified and, if necessary, eliminated. Before doing so, however, it must first be defined what a slow-moving item is; which is very industry- and company-dependent. Goods that are found to have been in storage for too long must therefore be scrapped, reused, returned or sold in a special sale. A warehouse clearance is particularly worthwhile for goods with a high inventory value (see also inventory management), but of course also for goods with a low unit value but a large quantity in stock.

- Optimization of inventory management

The aim of this measure is to ensure ideal availability for all goods that are regularly required, without keeping excessive stocks. Systematic procedures (e.g. ABC analysis) are available for such an analysis, which are usually supported by ERP and merchandise management systems as well as warehouse management systems (WMS).

- Needs-based inventory management

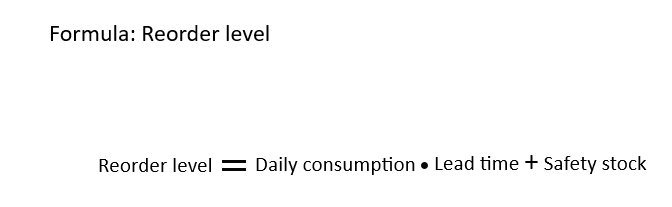

This involves determining the optimal stock level, which, from a certain size, can only be meaningfully managed using software solutions. The most important factors include average consumption, minimum stock, and the possible maximum stock (in terms of spatial capacity and capital value), as well as the replenishment lead time. If these parameters are used, both the optimal stock and the reorder point (reorder point for replenishment) are determined. This calculation is carried out automatically or semi-automatically by ERP systems at regular, fixed intervals (e.g. weekly).

- Setting maximum stock levels

A well-calculated maximum stock level should be set for goods with a high value, as otherwise they will tie up a lot of capital and contribute to correspondingly high storage costs. If it is difficult to reduce the maximum stock of such items because they are consumed very frequently, then delivery times can also be shortened and the order frequency increased (keyword: demand-driven delivery).

- Optimal procurement quantity

As each order also generates its own costs, it is advisable to determine the optimum procurement quantity using certain batch size formulas.

- Optimization of logistical processes

The logistical processes or process steps in a warehouse also hold great potential for optimization; for example, a storage location system can be introduced or routes and transport routes can be shortened, as is the case with manual sorting and picking (MSK).

Summary of warehousing costs, storage costs, storage costs

Storage costs include all costs associated with a warehouse and the corresponding storage processes. They are an important part of logistics costs and are used to determine cost-optimal procurement quantities, which are derived from lot size formulas and key figures. Low warehousing costs increase liquidity and are a result of the use of appropriate software solutions and automation measures. When determining warehousing costs, the key question is whether it is more cost-effective to procure a large quantity with a high storage range or to procure small quantities more frequently in order to keep warehousing costs constantly low.